Hello Folks

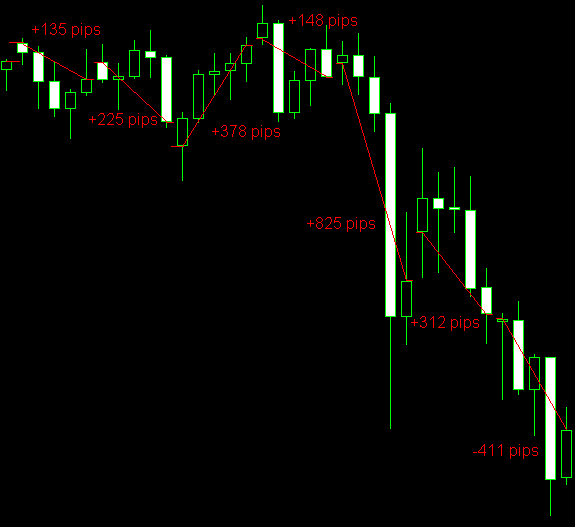

After a long wait...i finally introduce you to a new method.This is proven to be 80 percent profitable for me.

About Me : I have been trading forex for over 2 years now.Before the forex market i was trading stocks for a while.but forex was more interesting than the stupid stock market.

Sorry for my english..its not my mother tongue.

THE SYSTEM: TIME-FRAME 15

This strategy is based purely on price action.however just to confirm the same we will look where the price is bouncing off from.for example on any time frame the 200 EMA is very well respected.so this strategy we use only 15min timeframe.why coz less than 15min will give you more fakeys and more than this will take huge stoploss which is not ok with me.since i dont trade in millions..what we are trying to do here is to make maximum money with little investement.

I will explain in detail how to take these bounce trades after the TDI confirmation. I don't believe in adding lot of MA as it will spoil the look of the chart.The time we will look for trades is after the LONDON market opens..why?that is when more money will come to the market.more money means more momentum more momentum means more pips.more pips more money you can take home.

THE SETUP:

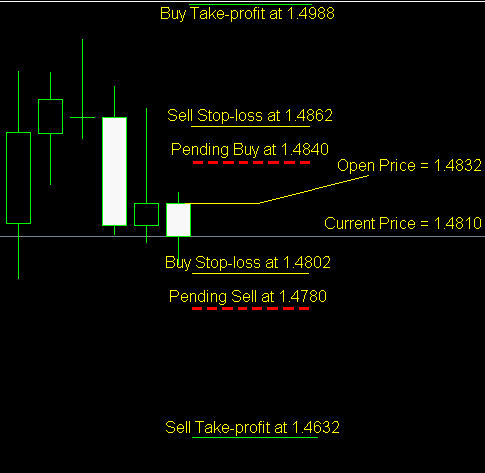

We will wait for the LONDON to open.after it opens we will look for trades AWAY from the 200 EMA.thre are more than one setup..but for the beginners of this system.please practice your eyes for this one setup and later I will elaborate on the other setups.Before you take a trade the price should close below the 10EMA for short and above 10EMA for long. MONEY MANAGEMENT SL is 20 Pips TP is upto a trader you may let it run till the tdi crosses back.or you may close at 1:1 upto you. As many other system even this has failure at very high volatile times.please demo it demo it demo it..till you become consistent with this strategy. I move my stop to BE after 12 pips..i don't want to give the pips back the market whats in my pocket.never risk more than 2 % on a single trade

This will be very easy if you already trading using TDI.For this setup the TDI GREEN should cross the Yellow line.Please read dean Malone TDI usage guide for more information on TDI..Later we shall talk about re entries and other setups later coz it will confuse all the newbies..see below for the chart attached

INDICATORS USED:11 1)200 EMA ( 1HR 50EMA) 2)800 EMA ( 4HR 50 EMA) 3) 10EMA 4)Round number indicator 5)Trading Time Indicator