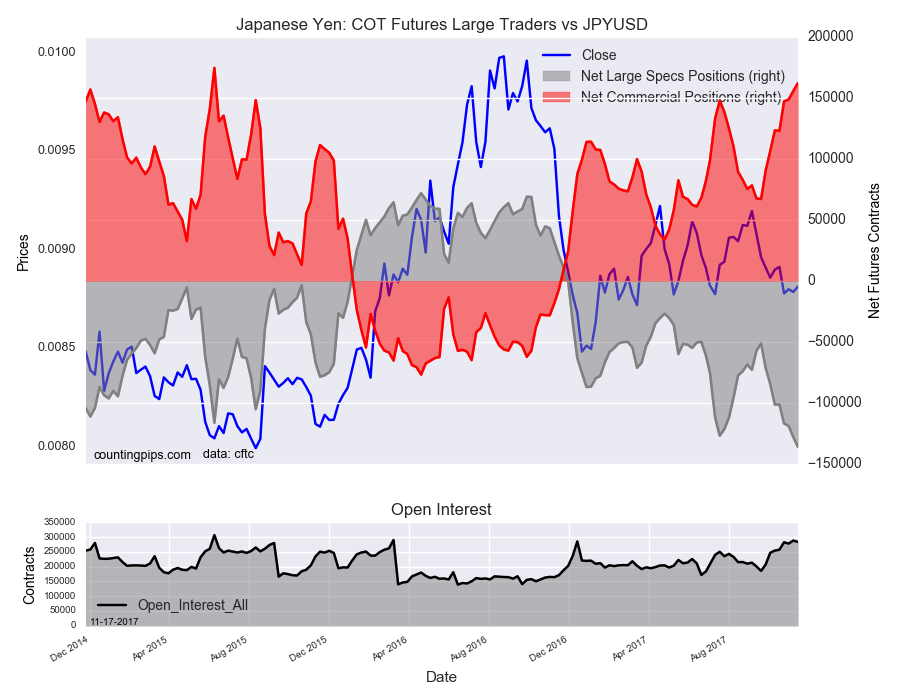

Not too long ago, on November 6th, the U.S. dollar climbed to as high as 114.73 against the Japanese yen, which was its highest level since mid-March. But instead of maintaining the bullish momentum, USD/JPY had a sudden change of heart and reversed to the south. Two trading weeks later, the pair closed slightly above the 112.00 mark after an intraday low of 111.94 on Friday, November 17th.

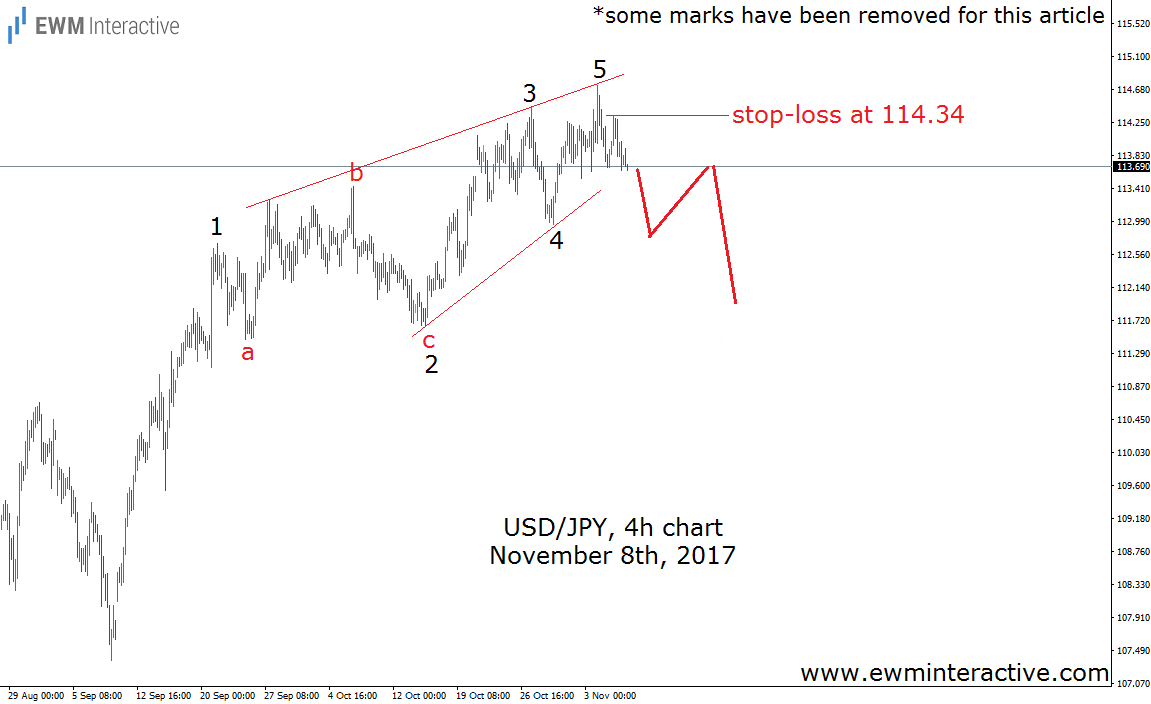

The good news is that the Elliott Wave Principle not only saved us the trouble to search for a reason for this 280-pip selloff, but also put us in the position to take advantage from the better part of it. The chart below was included in the mid-week update we sent to clients on Wednesday, November 8th.(some marks have been removed for this article)

Truth is while USD/JPY was hovering near 114.70, we thought it would go higher, too. But the moment the upper line of the above-shown leading diagonal discouraged the bulls, we knew the rally has been postponed. Which, in turn, revealed a nice short setup, whose targets lied near the support area of wave 2 of the pattern. Furthermore, the Wave principle helped us identify a concrete stop-loss level, in order to reduce the risk. As long as 114.34 was intact, lower levels were anticipated. The chart below shows how USD/JPY has been developing.

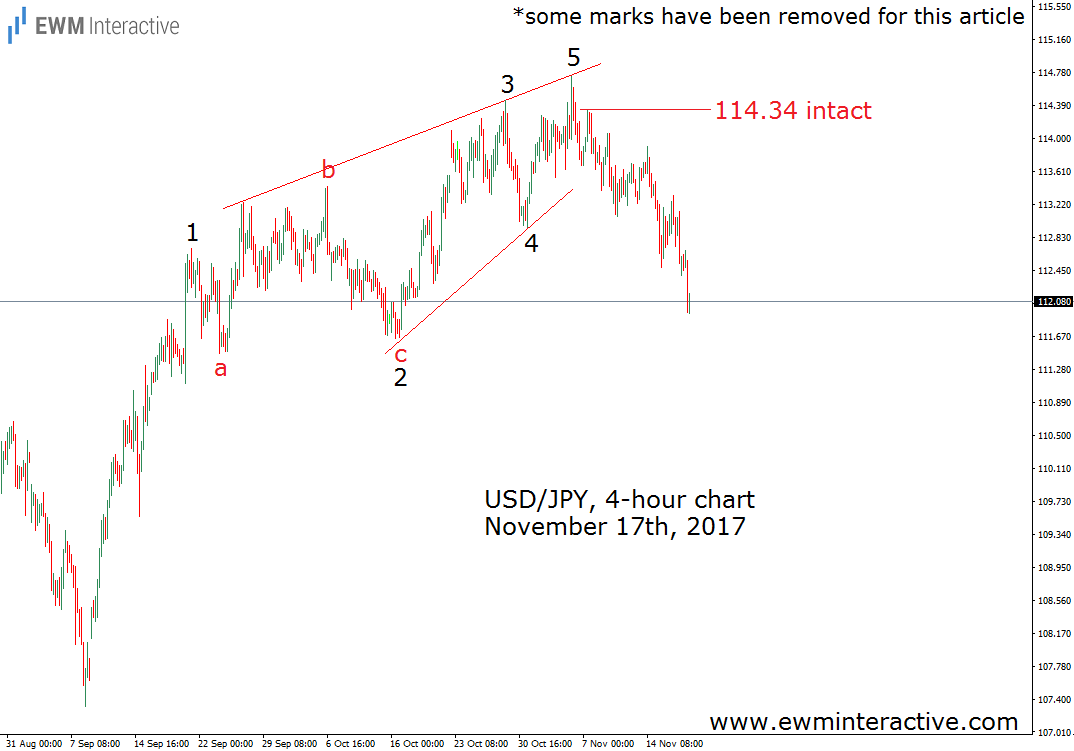

First, the all important 114.34 was far from danger the whole time. The rate continued to make lower highs and lower lows until it slightly breached the 112.00 mark yesterday. Once again, Elliott Wave analysis demonstrated its ability to put traders ahead of the news. Besides, the import-export relations between the United States and Japan did not matter, and neither did we have to pay much attention to the US House of Representatives passing the tax reform bill, because a single chart was all a technical analyst needs.

Original post